The Battle for Supremacy: Alibaba vs. Amazon

While Amazon has dominated the U.S. for years, Alibaba shares have increased 63.97% in the past twelve months, and a whopping 146.15% in the last two years. Amazon’s, meanwhile, have gained 67.76% and 121.44% during the same time period.

While there’s still some debate about which company will provide the most value to shareholders over the long-term, there’s also no doubt that Alibaba has carved out a niche for itself that allows it to continually outperform Amazon’s operating margins and remain a more profitable platform than its U.S.-based competitor.

Here’s what you need to know about the Alibaba vs. Amazon debate:

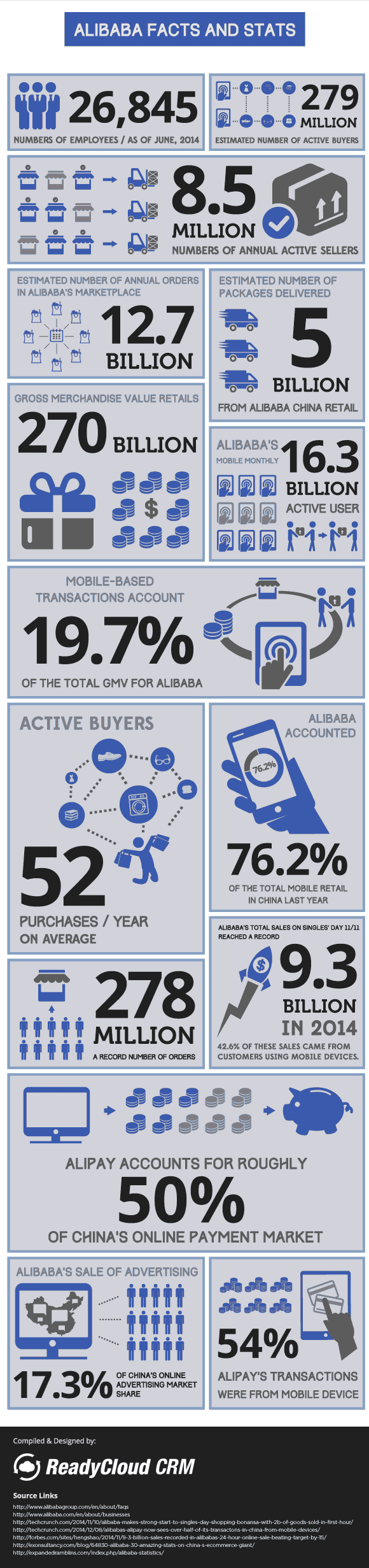

What you Need to Know About Alibaba

Alibaba is hot on the heels of Amazon. While Amazon is coming off of one of its best years yet, Alibaba continues to smash its numbers and outperform Amazon by a pretty wide margin. This year, Amazon’s stock has gone up 30%. Alibaba’s, meanwhile, has nearly doubled, and both Amazon recently became the first company to attain a market value of $1 trillion. There are two ecommerce giants, locked in a head-to-head battle with one another.

So, what’s the deal with Alibaba? How does it continue to outpace Amazon? Despite the fact that both are expanding into additional business ventures such as groceries, original content and the cloud, Alibaba remains the faster-growing and higher-valued platform. One of the largest reasons for this is the Chinese market. The Chinese middle-class is growing much faster than the U.S. middle class, and investors have put their hopes on Alibaba to remain a proxy for that growth. If it continues as projected, it stands to be a massive perk for the ecommerce platform, and the thing that continues to set it apart from Amazon.

Because of that growth, Alibaba has attracted some major backers in the hedge-fund space. It’s also earned a great deal of attention from analysts. Today, 47 brokers cover Alibaba, and not a single one has a sell rating. This is incredible seeing as Amazon has one sell rating out of the 44 analysts. This sell rating is about 17% of the mean target price of $1,150.46.

Today, Alibaba boasts a short position of about $23 billion. The next most shorted firm is Tesla, followed by Apple and AT&T. This ranking puts it in the company of giants, and virtually ensures it’s going to be one of the world’s most valuable companies for years to come.

The Current State of Amazon

In a world where brick and mortar stores are continuing to go under, Amazon has spent the last several years printing money. Last year, Amazon’s value peaked at an estimated $500 billion. At the same time, leading online retailers like Best Buy, Target, Costco, CVS and Walmart were worth about $411 billion combined.

Today, Amazon accounts for about 4% of all US retail sales and boasts some of the fastest-growing product categories, such as luxury and pantry items. As Amazon’s core demographic of millennials continues to grow up and develop, they’re shopping more and more on Amazon, which is driving the platform to grow to epic proportions. While it’s not quite competing with Alibaba, it is the most valuable and widely-used ecommerce platform in the U.S.

In 2017 alone, Amazon did more than $8 billion in electronics sales. This represents a year-over-year growth rate of 4%. During the same period, home and kitchen sales improved by 20%, publishing grew 3%, and sports and outdoors sales increased by 11%.

Here are some additional Amazon ecommerce statistics:

- Amazon grew by 50% in 2017.

- Amazon is now worth more than $1 trillion.

- Amazon bought Whole Foods for $14 billion.

- Jeff Bezos is the richest man in the world, worth more than $150 billion.

- Amazon unveiled seven private-label clothing brands in 2017.

- Amazon started streaming Thursday Night Football games for the NFL on Prime TV.

- Amazon’s HQ2 will add at least 50,000 jobs to the winning city.

- Bezos committed to investing $1 billion per year to save the world with his Blue Origin space exploration project.

Which One Will Come Out on Top?

As it stands right now, Alibaba boasts a more profitable business model than Amazon. This profitability is due in large part to key differences in how the two companies approach ecommerce.

While Amazon works to bring Walmart’s cost savings philosophy to the online environment. Amazon’s approach has worked well in the U.S., and it has secured a niche for itself as a high-volume, low-cost model that relies on massive scale and technology to create cost savings.

This has done well by Amazon, so far, although Alibaba has taken a different approach. Alibaba, by contrast, is working to build a more collective entrepreneurship platform and the ecommerce site relies more on a network business model, as a result.

For now, Amazon’s saving grace seems to be purely geographical. There’s no doubt that the company’s eBay-esque approach to ecommerce has taken off among Chinese consumers, or that it would be incredibly popular in the United States if given the chance.

Regardless of who ultimately comes out on top, there’s one thing nobody can doubt: that both Alibaba and Amazon have dominated the world of ecommerce and taken very different approaches to carve out their niche within it. As the ecommerce world continues to evolve, so will these dynamic and customer-centric shopping platforms.

At the end of the day, the question may not be Alibaba vs. Amazon, but, instead, how will both change the online environment forever?

Share On: