Amazon Was King of the Jungle in 2017

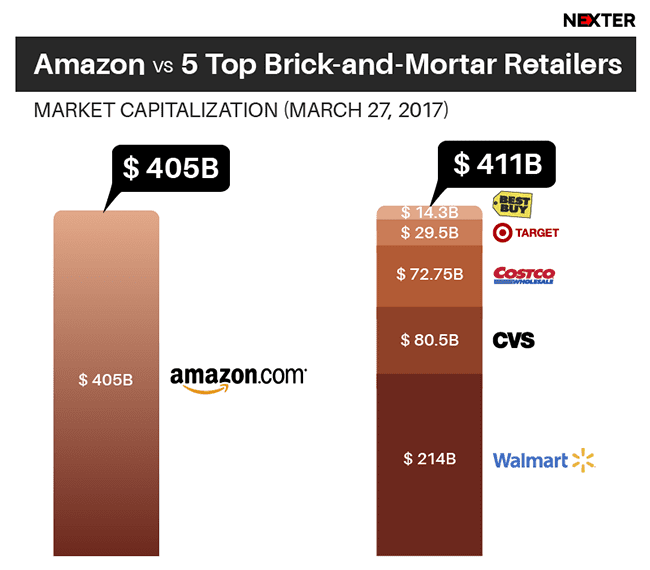

As brick and mortar stores shutter their doors, Amazon is printing paper (money that is) in hordes. A recent NEXTER publication compared the top-five brick and mortar stores to Amazon’s capitalization (for 2017), and it wasn’t even close. Not by a longshot.

The findings revealed that Amazon’s worth had peaked at an estimated $405 billion. Meanwhile, leading online retailers—consisting of Best Buy, Target, Costco, CVS and Walmart combined—tallied just $411 billion.

Let that sink in for a moment.

America’s top-five brick and mortar retailers combined to eclipse the Amazon behemoth by a fickle $6 billion.

These findings, coupled with the fact that numerous brick and mortar retailers were going belly up—the likes of which include Toys R Us, Charming Charlie, Styles for Less, Perfumania, Aerosoles, Vitamin World, Alfred Angelo, Rue21, True Religion, Payless and others—help us better understand why Amazon truly was King of the Jungle in 2017.

Amazon Owns 4% of Retail Sales

Amazon Owns 4% of Retail Sales

In order to be King, one must have command over their domain. This is omnipresent with Amazon, which according to CNBC, was on the receiving end of 4% of all U.S. retail sales in 2017. Of the fastest growing product categories for Amazon this past year, topping the list were luxury beauty and pantry items—namely those hosted in the popular Prime Pantry, and offered to consumers at breakneck prices that have sent other retailers scrambling to compete against.

“Every major trend we see across 2017 can be explained by the fact that more of Amazon’s core demographic (millennials) are growing up: they’re increasingly owning homes, raising children, and buying a TON of stuff to go with it,” explained One Click Retail CEO Spencer Millerberg in his annual report.

He then added: “This raises the question: will this create long-term changes and tailwinds for Amazon? Will 300-ish Whole Foods stores be enough to compete meaningfully in the brick-and-mortar space against Walmart’s 4000+ stores?”

As compared to 2016 Amazon sales tallies, Luxury Beauty Products saw an increase of 47% in sales; Pantry items improved sales numbers by 38%; Grocery sales shot up by 33%; Furniture sales were improved by 33%.

All told, Amazon did more than $8 billion in Electronics sales for 2017, it’s healthiest division by far. This represents a year-over-year growth of 4% for that category. Meanwhile, Home & Kitchen sales improved by 20%, Publishing was up 3%, and Sports & Outdoors sales saw an 11% improvement. Combined, each category generated an estimated $23 billion in sales for the online juggernaut.

All told, Amazon did more than $8 billion in Electronics sales for 2017, it’s healthiest division by far. This represents a year-over-year growth of 4% for that category. Meanwhile, Home & Kitchen sales improved by 20%, Publishing was up 3%, and Sports & Outdoors sales saw an 11% improvement. Combined, each category generated an estimated $23 billion in sales for the online juggernaut.

The King of the Jungle Was Roaring in ‘17

The King of the Jungle Was Roaring in ‘17

Business Insider nailed it when they used this as their opening title for an Amazon article mid-December of last year: “Amazon dominated online shopping in 2017 — and it wasn’t even close.”

With Amazon’s stock, AMZN (Amazon.com), up to 1,209.59 per share (as of the writing of this article), it’s easy to understand why BI would title an article like that. As Walmart rolled out free two-day shipping for online orders of $35 and more last year to attract new customers, Amazon fired back with free two-day shipping for non-Prime members on orders of just $25 and more.

What’ more, Amazon also worked out a deal with Nike to finally debut the sports gear maker’s line on their website. The e-tail giant also enamored apparel shoppers with the rollout of Prime Wardrobe—a subscription box-like service that lets consumers try clothing before they buy it, with a seven-day try-on period and no-questions-asked returns.

In between this, Amazon tested an in-store return program in partnership with Kohl’s, where consumers can instead drop off a return at select stores to get an instant refund.

“We are thrilled to launch this unprecedented and innovative concept, allowing customers to bring in their unpackaged Amazon returns to Kohl’s and we will pack them, ship them, and return them to Amazon for free,” said Richard Schepp, Chief Administrative Officer in a Kohl’s press release announcing the deal. “This is a great example of how Kohl’s and Amazon are leveraging each other’s strengths – the power of Kohl’s store portfolio and omnichannel capabilities combined with the power of Amazon’s reach and loyal customer base.”

As a final nail in the coffin, and in efforts to win over college shoppers, Amazon also unveiled Instant Pickup, a service where limited college campuses allow students to pickup their orders on campus with a nearly instant delivery method from orders placed using the Amazon shopping app.

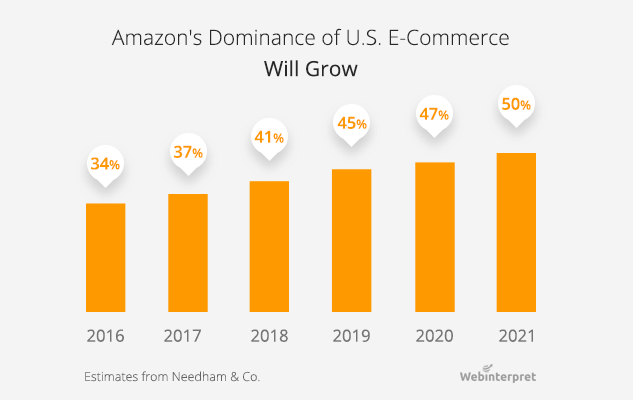

As it turns out, this WebInterpret chart from Q1 2017 was spot on.

Jeff Bezos Earned the World Title

Amazon’s founder, Jeff Bezos, is No. 1 on the Recode 100, with the publisher exalting him by proclaiming: “Jeff Bezos won 2017 — and set Amazon up to dominate the next decade.”

Underscoring this proclamation are these new 2017 Amazon statistics:

- Amazon grew by 50% in 2017

- Amazon is now worth more than $550 billion

- Amazon bought Whole Foods for $14 billion

- Jeff Bezos is the richest man in the world, worth more than $100 billion

- Amazon unveiled seven private-label clothing brands in 2017

- Amazon started streaming Thursday Night Football games for the NFL on Prime TV

- Amazon’s HQ2 will add 50,000 jobs to the winning city

- Bezos committed to investing $1 billion per year to save the world with his Blue Origin space exploration project

Prime Day Set New Records

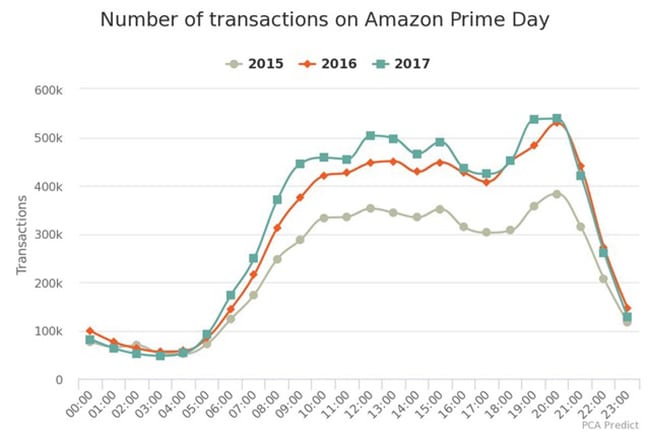

With all of this talk about Black Friday and Cyber Monday, the real online shopping holiday to watch in 2017 was actually Amazon Prime Day. This past year, the e-tailing shopathon smashed old records and set new ones, as it has for the past three years in a row.

For 2017, Prime Day bolstered sales by a whopping 60% from the previous year, generating more than $2 billion in sales over just 24 hours. The online shopping holiday features doorbuster deals that Amazon calls “Lightning Deals” that are offered by thousands of competing online retailers, made available only to Prime users during Amazon Prime Day.

Unsurprisingly, Prime Day bested the two years that preceded it, setting new all-time sales records for retailing that won’t be beat any time soon… with exception, of course, to the forthcoming Prime Day in 2018. Illustrating this is the transaction chart below.

5 Billion Prime Shipments in 2017

5 Billion Prime Shipments in 2017

Speaking of Prime, it was a big part of why Amazon was King of e-commerce in 2017. More than 5 billion items were shipped to Prime members in 2017, Business Wire reports, with members taking advantage of the free two-day shipping offerings, included live streaming TV, and digital streaming movies and music services, in addition to a cadre of other benefits offered to Prime users.

“From Fire TV Stick and Echo Dot to Imagine Dragons, Manchester by the Sea and even the Instant Pot, Prime members certainly have great taste! Tens of millions of members around the world enjoy the many benefits included with Prime, and in fact, more new paid members joined Prime worldwide this year than any previous year. In 2017, more than five billion items worldwide shipped with Prime and members used digital benefits like Prime Video, Prime Music and Prime Reading more than ever before,” said Greg Greeley, Vice President of Amazon Prime in a January 2nd press release. “Our Best of Prime feature not only demonstrates what was trending this year, it also gives us insight into what members love, providing additional inspiration as we continue to innovate, invest and make Prime even better in 2018.”

Helping to further feed this retail beast was an expansion of Prime products from 50 million to 100 million for 2017, with added and free one-day shipping available to more than 8,000 U.S. cities and towns, and same-day, free delivery offered in more than 30 major cities.

Thanksgiving is Actually “Amazon Weekend”

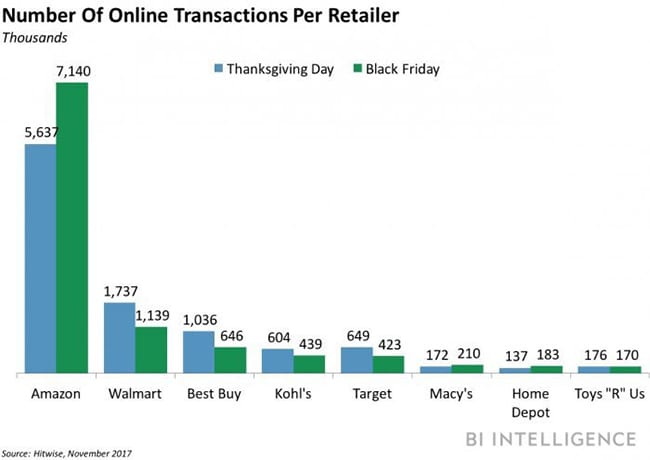

Circling back to Thanksgiving weekend, where the two healthiest shopping days of the year take place, Black Friday (the Friday after Thanksgiving) and Cyber Monday (the Monday following Thanksgiving), Amazon once again bared its teeth and proved that it was King of the Jungle.

Over this past Thanksgiving weekend, the marketplace pulled in a whopping 45% of online transactions on Thanksgiving day, 54.9% of transactions on Black Friday and around 50% of all transactions on Cyber Monday, reports Business Insider. Given these Amazon statistics, it seems more palpable to relabel this weekend simply as: “Amazon Prime Weekend.”

Moody’s Doesn’t Rank Amazon Well

In spite of all this exaltation, there is one critic that’s still not sold on the Amazon wonder story: Moody’s. As MarketWatch reports, much of the hype surrounding Amazon’s rapid climb up the ranks of online retail to Kingdom status doesn’t really transfer over to the U.S. brick and mortar retail gambit, even though Amazon recently acquired Whole Foods in a blockbuster deal.

“That potential is overshadowing the superior real-time operating performance of Amazon’s key retail competitors,” wrote Charlie O’Shea, Moody’s vice president and lead retail analyst in his annual report. “The emphasis on stock performance is, in our view, forcing brick-and-mortar competitors toward managing more irrationally for short-term performance just when they’re confronting secular change.”

“Online sales still account for only about 10% of overall U.S. retail sales, with a much lower percentage in the grocery segment, leaving the big brick-and-mortar retailers, led by Walmart, still really formidable competitors in the industry,” he added.

Moody’s instead pegs Amazon as a “disruptive retailer” that notches easy wins in some categories, and that lags in others. For example, Best Buy and its popular Geek Squad service appeals to millions of consumers nationwide, and is backed by a powerful workforce of 20,000 employees—something Moody’s determines makes it difficult, if not impossible, for Amazon, an online marketplace conglomeration of merchants, to match the efforts of.

The long and the short of it is this: Amazon took in 4% of all U.S. retail sales and 44% of all online e-commerce sales for 2017. That in and of itself makes it King.

And while analysts like Moody’s do make a good point, the reality is that Amazon isn’t trying to be King of the retail world.

What the retailer has successful become, however, is King of the Jungle.

Staying Ahead of the Curve

As you can see, the new digital marketing world is a multichannel parallel universe. It requires a succinct approach and a unique strategy to derive success. No longer to do marketers have to be ill-equipped to pursue such a strategy. That’s where ReadyCloud CRM comes in.

Share On: